Alhambra Bankruptcy Attorney

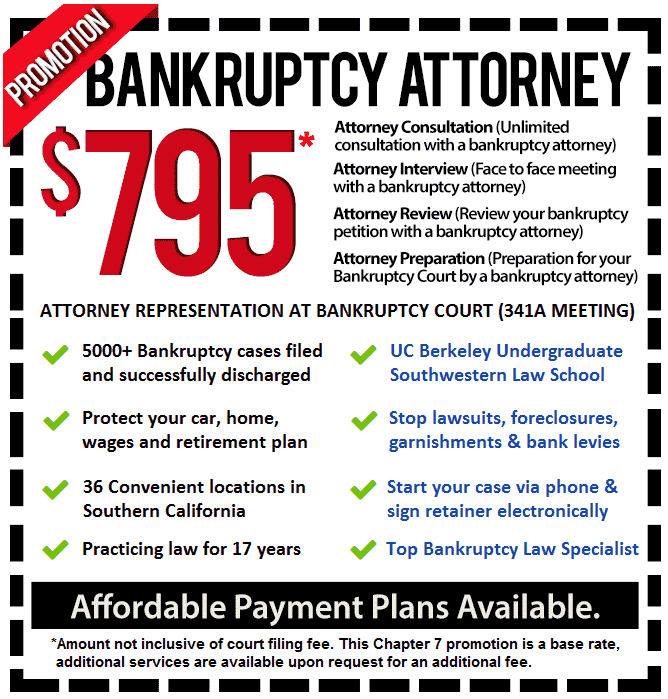

Bankruptcy can be a realistic and very practical solution for Alhambra consumers and business owners. If staring at increasing debt and loss of assets from court judgments, Alhambra residents can call an Alhambra bankruptcy attorney at 626-461-9006.

An Alhambra bankruptcy attorney can counsel you on Chapter 7, 11 or 13 depending on whether you are filing personally or for a business or even both. A Chapter 7 can wipe out unsecured consumer or business debt. Chapter 13 is for individuals who cannot file Chapter 7 or who would lose too many assets. And Chapter 11 is for struggling businesses seeking to reorganize while repaying creditors over time.

Consult an Alhambra bankruptcy attorney about the various types of bankruptcy. You can trust an experienced and skilled Alhambra bankruptcy attorney to handle your bankruptcy case professionally and competently.

Chapter 7 Bankruptcy

Alhambra debtors can file Chapter 7 to cancel unsecured debt such as medical bills, credit cards, personal loans, most payday loans and department store bills. A Chapter 7 bankruptcy lawyer confirms your eligibility by matching your income to state criteria and ensuring that your disposable income, if any, is not too high.

The Chapter 7 bankruptcy lawyer prepares a petition to be filed after you complete a debt counseling course arranged by the Chapter 7 bankruptcy lawyer. You and your Chapter 7 bankruptcy lawyer will then attend a brief 341 Meeting with the trustee to review your financial affairs.

Any secured debt you have can be reaffirmed, redeemed at replacement value or returned to the creditor. Alhambra businesses that file have their assets liquidated as they wind up their business in an orderly fashion. Talk to an Alhambra bankruptcy lawyer for more information.

Chapter 13 Bankruptcy

A Chapter 13 bankruptcy attorney may find you ineligible for Chapter 7 or recommend a Chapter 13. Most recommendations by Chapter 13 bankruptcy attorneys are because the debtor has too many valuable assets that would be lost in Chapter 7 including a home to foreclosure or auto or boat to repossession.

Your Chapter 13 bankruptcy attorney prepares a plan where you repay creditors over 3 or 5 years in order of priority. Secured creditors are paid in full while unsecured may not receive any funds. You make a single monthly payment to the trustee for distribution. You can include arrearages in your mortgage, student loan, auto or court-ordered support payments.

Sole proprietors in Alhambra can file and keep their business running. Business debts can be in the plan but only if they are personally guaranteed.

If you complete the plan, any unsecured debt can be discharged. See an Alhambra bankruptcy lawyer for more information.

Chapter 11 Bankruptcy

Corporations, LLCs and partnerships unable to remain solvent can seek to revive their operations by filing Chapter 11. A Chapter 11 bankruptcy attorney files a disclosure statement and reorganization plan that places creditors in classes and informs them on how they will be paid. Creditors are also advised on how the reorganization will potentially bring the business back to profitability.

If the impaired creditors confirm the reorganization plan, the business can keep operating and implement its restructuring including breaking and entering into new contracts and leases, hiring business specialists, selling assets and finding investors but with prior court approval. Your Chapter 11 bankruptcy attorney keeps the court informed with periodic progress reports.

Individuals can file as well if they are ineligible to file under other chapters. Smaller businesses can file Chapter 7 but should be counseled by an Alhambra bankruptcy lawyer on how they are treated under Chapter 11.

Call an Alhambra bankruptcy lawyer at 626-461-9006 about how a bankruptcy might be the solution to an intractable debt problem.